Unified Bank: Your Future Of Seamless Financial Solutions

In an increasingly complex world, managing your finances can often feel like navigating a labyrinth of separate accounts, disparate services, and endless logins. But what if there was a single, cohesive entity designed to simplify every aspect of your financial life? This is the promise of a unified bank – an institution that brings together all your financial needs under one roof, offering a streamlined, intuitive, and truly integrated experience.

Imagine a financial partner that understands your journey, whether you're an individual planning for the future, a small business striving for growth, or a family building wealth. A unified bank isn't just about convenience; it's about a fundamental shift in how financial services are delivered, focusing on comprehensive solutions, cutting-edge technology, and a deep commitment to customer well-being. This article delves into the transformative power of the unified bank model, exploring its core principles, innovative offerings, and why it represents the next evolution in personal and business finance.

Table of Contents

- The Core Philosophy of a Unified Bank: Bringing Everything Together

- Comprehensive Financial Solutions for Every Customer

- Digital Transformation: The Unified Bank App Experience

- The "Unified Way": A Culture of Respect and Support

- Specialized Expertise Within a Unified Framework

- The Power of a Unified System: Efficiency and Clarity

- Beyond Banking: Unified Approaches in Daily Life

- Why Choose a Unified Bank? Trust, Convenience, and Growth

The Core Philosophy of a Unified Bank: Bringing Everything Together

At its heart, the concept of "unified" means "brought together as one." It refers to being combined, linked, or made into a whole, often implying harmony and agreement among its various parts or components, all aiming at a common objective or sharing a common purpose. In the context of finance, a unified bank embodies this definition by consolidating diverse banking services and products into a single, seamless ecosystem. This isn't just about offering a checking account alongside a savings account; it's about integrating everything from personal loans and mortgages to business banking solutions, investment opportunities, and digital tools into one cohesive platform.

The traditional banking landscape often requires customers to engage with multiple departments or even different institutions for varying financial needs. A mortgage might be handled by one division, while a business loan comes from another, and personal investments are managed by a third-party brokerage. This fragmentation can lead to inefficiencies, inconsistent experiences, and a lack of holistic financial oversight. A unified bank dismantles these silos, creating a singular point of contact and a consistent experience across all touchpoints. This approach ensures that whether you are a small business or an individual, the bank is "Always by your side," offering financial solutions through its products and services for all of its customers.

Comprehensive Financial Solutions for Every Customer

A true unified bank prides itself on its ability to serve a diverse clientele with tailored solutions. This means understanding that the financial needs of an individual saving for a home are vastly different from those of a small business managing payroll and seeking expansion capital. Yet, a unified bank aims to address both with equal proficiency and integrated support.

Tailored Services for Individuals and Families

For individuals, a unified bank simplifies personal finance. Gone are the days of juggling multiple accounts at different banks to optimize benefits. A unified bank offers a comprehensive suite of personal banking products designed for ease and flexibility. This includes features that truly benefit the everyday user, such as "No minimum daily balance requirement," which removes a common barrier to entry and stressor for many. Furthermore, the provision of "Unlimited transactions and check writing" ensures that managing daily expenses and payments is never restricted or penalized. The added perk of "Free personalized checks (a $7.99 shipping & handling fee only)" highlights a customer-centric approach, making banking more affordable and convenient. This holistic approach ensures that all personal financial needs, from basic checking to savings and even investment opportunities, are seamlessly accessible within a single framework.

Empowering Small Businesses with Integrated Support

Small businesses are the backbone of the economy, and a unified bank recognizes their unique challenges and aspirations. Rather than offering generic business accounts, a unified approach provides integrated solutions that support growth and operational efficiency. This might include specialized business checking accounts with features similar to personal ones, but also extends to tailored credit lines, merchant services for processing payments, and even payroll solutions. By offering a comprehensive suite of business products and services, a unified bank acts as a strategic partner, helping small enterprises manage their cash flow, secure funding for expansion, and streamline their financial operations, all from a single, trusted platform. This integrated support helps businesses thrive, reinforcing the bank's commitment to being "Always by your side."

Digital Transformation: The Unified Bank App Experience

In today's fast-paced digital world, accessibility and convenience are paramount. A cornerstone of the unified bank model is its robust digital platform, epitomized by the "unified bank app." This isn't just another banking app; it's a powerful, intuitive tool designed to give customers complete control over their finances, anytime, anywhere. "With our unified bank app, you can manage your money from anywhere, at any time." This promise translates into tangible benefits for the user.

Imagine being able to "Check your balances, transfer funds and make deposits from your phone!" with just a few taps. This level of functionality goes beyond basic mobile banking, offering a truly comprehensive financial management hub. The app serves as your personal financial command center, allowing for real-time tracking of transactions, setting up bill payments, managing budgets, and even applying for new products. The integration of all services within one app means no more switching between different platforms or remembering multiple logins for various accounts. This streamlined digital experience not only enhances convenience but also significantly improves financial literacy and control for the user, making complex financial tasks surprisingly simple.

The "Unified Way": A Culture of Respect and Support

Beyond products and technology, the essence of a unified bank lies in its foundational culture. It's not merely about combining services; it's about fostering an environment where both customers and employees thrive. The mission statement, "Our mission is to be the world's most respected financial services provider," speaks volumes about this commitment. Respect, in this context, extends to every interaction, every policy, and every innovation.

To achieve this ambitious mission, a unified bank establishes a unique operational philosophy, often referred to as "our unified way." This culture "supports our team members, so they can" deliver exceptional service. When employees feel valued, supported, and empowered, they are better equipped to provide empathetic, knowledgeable, and efficient assistance to customers. This internal harmony directly translates to external benefits: a consistent, high-quality customer experience where every query is met with expertise and every challenge with a solution. This deep-seated culture of support ensures that the bank lives up to its promise of being "Always by your side," building trust and fostering long-term relationships based on mutual respect and understanding.

Specialized Expertise Within a Unified Framework

While the concept of "unified" suggests a broad, all-encompassing approach, it does not mean a dilution of specialized expertise. On the contrary, a truly unified bank integrates specialized professionals directly into its comprehensive service model, ensuring that customers receive expert guidance precisely when they need it, all within the familiar and trusted environment of their primary financial institution.

Personalized Mortgage Loan Origination

Consider the complex process of securing a mortgage. This often requires highly specialized knowledge of market rates, loan types, and regulatory requirements. A unified bank brings this expertise in-house. For example, individuals like "Logan Wojcik mortgage loan originator OH, WV, & PA" and "Janelle Cline mortgage loan originator Ohio" represent the dedicated specialists available to guide customers through one of life's most significant financial decisions. Their presence within the unified bank means that customers don't need to seek external brokers or navigate disparate lending institutions. Instead, they receive personalized, expert advice seamlessly integrated with their existing banking relationship, ensuring a smooth and efficient process. This specialized support underpins the bank's commitment to being "Always by your side," offering expert guidance for critical financial milestones.

Broader Financial Services and Product Offerings

Beyond mortgages, a unified bank's comprehensive offerings extend to various financial products designed to help customers grow their wealth. Certificates of Deposit (CDs), for instance, are a popular option for stable, low-risk savings. A unified bank transparently outlines the terms for these products, such as "CD rates require a minimum of $1,000 to open and attain the stated APY." It also clarifies important details like the Annual Percentage Yield (APY), stating, "APY = Annual Percentage Yield," and noting that "the APY’s are accurate as of 5/1/25." Crucially, it also informs customers about potential implications, such as "Penalty may be imposed for early" withdrawal, ensuring full transparency. This breadth of offerings, coupled with clear communication and specialized support, demonstrates how a unified bank provides a complete financial ecosystem, addressing diverse needs from daily transactions to long-term investment strategies.

The Power of a Unified System: Efficiency and Clarity

The true strength of a unified bank lies in its systemic approach. "A unified system, process, etc, Has the same rules or laws for all the people, organizations, or countries that are affected by it." This principle, often seen in legal or governmental structures (like a "unified judicial system" where "cases move forward quickly"), directly translates to significant advantages in the financial sector. When a bank operates under a unified system, it means consistent policies, standardized procedures, and a singular approach to customer service across all its offerings and departments.

This consistency eliminates confusion, reduces errors, and significantly streamlines operations. For the customer, it means a predictable and reliable experience, whether they are opening a new account, applying for a loan, or resolving an issue. The absence of bureaucratic hurdles and fragmented processes leads to greater efficiency and faster turnaround times. This operational clarity builds immense trust, as customers know what to expect and can rely on the bank to deliver services consistently and fairly. The unified approach fosters a sense of transparency and accountability, reinforcing the bank's role as a dependable financial partner.

Beyond Banking: Unified Approaches in Daily Life

The concept of "unified" extends far beyond the financial sector, illustrating its universal benefits. Consider the example of the "UMANG (Unified Mobile App for New Governance)" in India, where "EPFO services are now available on the UMANG" app. This app, which "can be downloaded by giving a missed call 9718397183," exemplifies how disparate government services can be brought together into a single, accessible digital platform for public convenience. This parallels the vision of a unified bank: consolidating diverse services into one user-friendly interface.

Another example of a unified approach can be seen in procurement and supply. "Unified's goal is to provide personal and professional service in the area of office supply purchasing, furniture, janitorial and technology products." With "30,000 items to choose from," such a company simplifies complex purchasing needs by offering a vast array of products from a single source. This eliminates the need for multiple vendors, streamlining ordering and logistics for businesses. These real-world examples underscore the inherent value of a unified approach: simplifying complexity, enhancing efficiency, and improving accessibility across various domains. The success of these models reinforces the compelling argument for a unified bank, demonstrating how consolidation can lead to greater convenience and effectiveness in managing diverse needs.

Why Choose a Unified Bank? Trust, Convenience, and Growth

In a world where financial decisions can profoundly impact your life, choosing the right banking partner is paramount. A unified bank stands out as a compelling choice for those seeking simplicity, security, and comprehensive support. By bringing together all financial solutions under one roof, it eliminates the fragmentation and complexity often associated with traditional banking models. The promise of managing your money "from anywhere, at any time" through a powerful app, coupled with features like "No minimum daily balance requirement" and "Unlimited transactions," speaks directly to modern financial needs for convenience and accessibility.

More than just a collection of services, a unified bank operates on a foundational culture of respect and support—"our unified way"—ensuring that every customer interaction is met with professionalism and care. The integration of specialized expertise, from mortgage loan originators to diverse product offerings like CDs, means you receive tailored advice within a consistent, trustworthy framework. This commitment to efficiency, clarity, and customer-centricity means a unified bank is truly "Always by your side," empowering you to manage your finances with confidence and clarity. It's not just about banking; it's about building a lasting partnership that supports your financial journey at every step.

Explore how a unified bank can simplify your financial life and provide the comprehensive support you deserve. Share your thoughts on integrated banking below, or discover more about our innovative solutions designed to put you in control of your financial future.

- Pugh Funeral Home Asheboro Nc

- Galesburg Obituaries

- Mexican Lasagna Recipe

- Able Ammo

- Kill Devil Grill

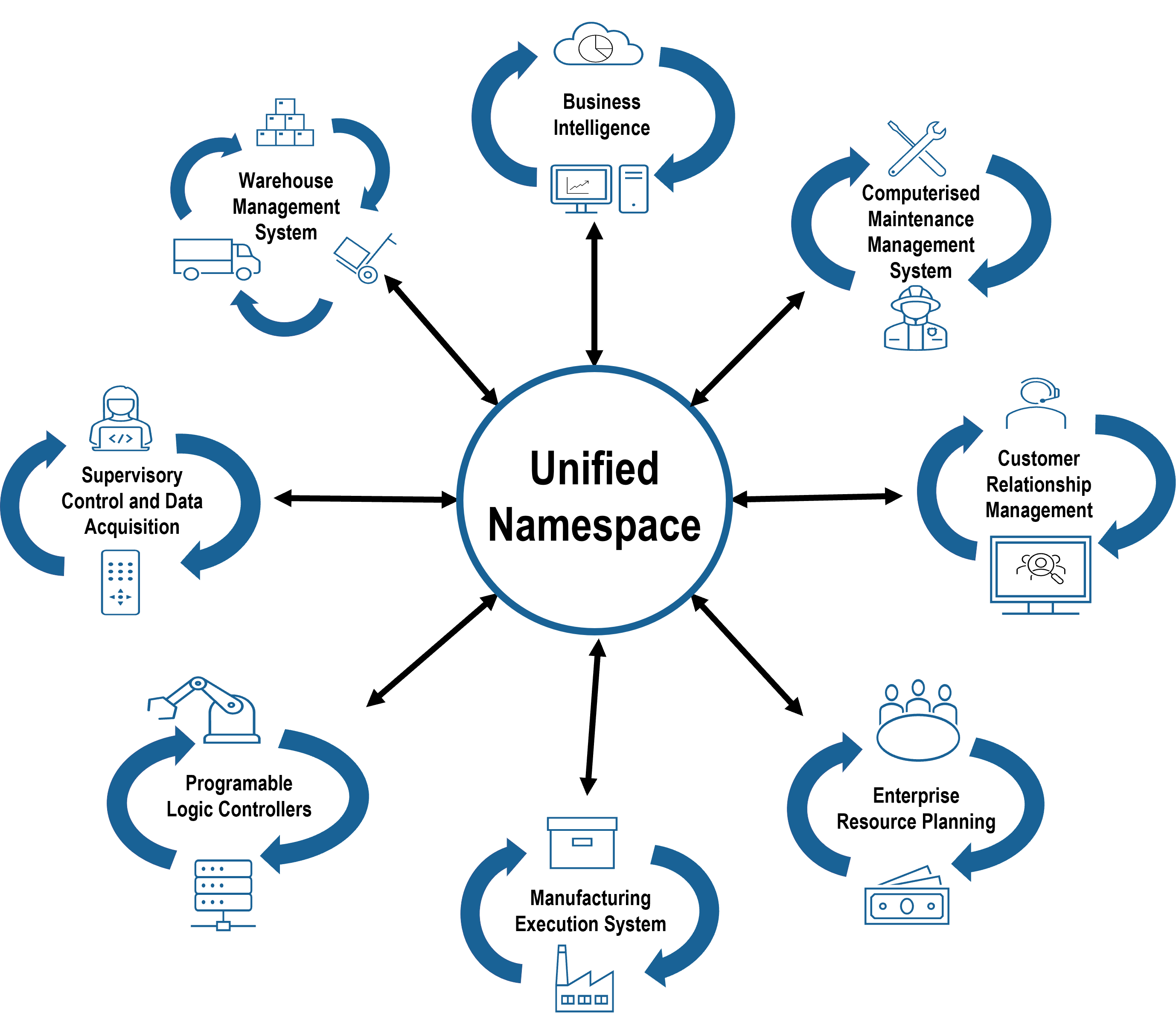

Unified Namespace • Op-tec Systems

Unified Synergy Teamwork Vector Illustration Icon Logo, Ideal Visual

Unified Namespace Part 1: A digital transformation must-have