Unlock Wealth: Your Guide To How To Get Rich & Stay Rich

The dream of financial independence, of having enough resources to live life on your own terms, is a universal aspiration. Many wonder, "how to get rich?" It's a question that sparks countless discussions, from personal finance blogs to high-stakes investment forums. While there's no magic formula or overnight solution, the path to substantial wealth is built upon a combination of strategic decisions, consistent effort, and a deep understanding of how money works and how value is created. This comprehensive guide will demystify the process, offering actionable insights and proven strategies to help you navigate your journey toward lasting prosperity.

Achieving significant wealth isn't merely about accumulating a large sum of money; it's about cultivating a mindset, mastering financial literacy, making intelligent investments, and often, building something of your own. It requires discipline, patience, and a willingness to learn and adapt. From understanding the fundamentals of saving and investing to exploring the entrepreneurial landscape and even the critical role of business location, we'll delve into the multifaceted approach that truly answers the question of how to get rich and, crucially, how to stay rich.

Table of Contents

- The Mindset of Millionaires: Cultivating a Wealth-Building Mentality

- Strategic Savings and Intelligent Investments: The Foundation of Wealth

- Entrepreneurship as a Catalyst: Building Your Own Path to Riches

- The Power of Place: Why Location is Paramount for Business Success

- Navigating the Business Landscape: Threats and Opportunities

- Diversification and Risk Management: Protecting Your Growing Wealth

- Continuous Learning and Adaptation: Staying Ahead in the Wealth Game

- Giving Back: The Philanthropic Aspect of True Riches

The Mindset of Millionaires: Cultivating a Wealth-Building Mentality

Before you can truly understand how to get rich, you must first cultivate the right mindset. Wealth creation isn't just about numbers; it's about your beliefs, habits, and approach to money. Millionaires often share common psychological traits: they are resilient, persistent, embrace calculated risks, and view challenges as opportunities. They understand that setbacks are part of the journey and that learning from failures is crucial for long-term success. This proactive and growth-oriented perspective sets the stage for all subsequent financial actions.

A scarcity mindset, where one constantly fears losing money or believes there isn't enough to go around, can be a significant barrier. Conversely, an abundance mindset, which focuses on possibilities and growth, opens doors to innovative solutions and greater financial potential. It’s about seeing yourself as capable of creating wealth, not just earning a paycheck. This fundamental shift in thinking is the bedrock upon which all other strategies for how to get rich are built.

Financial Literacy: Your First Step to Getting Rich

You wouldn't attempt to build a house without understanding basic construction principles, nor should you try to build wealth without understanding fundamental financial concepts. Financial literacy is the cornerstone of how to get rich. It encompasses understanding budgeting, saving, debt management, investing, and the power of compound interest. Many people struggle financially not because they don't earn enough, but because they lack the knowledge to manage what they have effectively.

- Budgeting: Know where your money goes. A clear budget helps you identify unnecessary expenses and allocate funds towards savings and investments.

- Saving: Make saving a priority, not an afterthought. Aim to save a portion of every income, even if it's small to start.

- Debt Management: Understand the difference between "good" debt (like a mortgage or student loan that can increase your net worth or earning potential) and "bad" debt (high-interest credit card debt). Prioritize paying off high-interest debt first.

- Investing Basics: Learn about different investment vehicles like stocks, bonds, mutual funds, and real estate. Understand risk tolerance and diversification. Resources like Investopedia, books by financial advisors like Dave Ramsey or Robert Kiyosaki, and reputable financial news outlets can be invaluable.

Setting SMART Financial Goals

Vague aspirations like "I want to be rich" are rarely effective. To truly figure out how to get rich, you need specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals provide a roadmap and motivation for your financial journey.

- Jennifer Lynn Stone

- Bob Johnson Toyota

- South County Mall

- Embassy Suites By Hilton San Diego Bay Downtown

- John Stamos Tv Shows

- Specific: Instead of "save money," try "save $50,000 for a down payment."

- Measurable: How will you track progress? (e.g., "track monthly savings").

- Achievable: Is the goal realistic given your current income and expenses?

- Relevant: Does this goal align with your broader financial aspirations and life vision?

- Time-bound: Set a deadline (e.g., "by December 2030").

Breaking down large goals into smaller, manageable steps makes the journey less daunting and helps maintain momentum. Regularly review and adjust your goals as your circumstances change.

Strategic Savings and Intelligent Investments: The Foundation of Wealth

While earning more is certainly a component of how to get rich, effective management of your existing income through strategic savings and intelligent investments is equally, if not more, crucial. Savings provide the capital for investment, and investments, when chosen wisely, allow your money to work for you through the power of compounding. Albert Einstein reportedly called compound interest the "eighth wonder of the world," and for good reason. Reinvesting your earnings allows your wealth to grow exponentially over time.

Consider the "pay yourself first" principle: automate transfers from your checking account to your savings and investment accounts immediately after receiving your paycheck. This ensures you prioritize your financial future before discretionary spending. For investments, diversification across different asset classes (e.g., stocks, bonds, real estate, commodities) is key to mitigating risk. Historically, the stock market has offered significant returns over the long term, but it's essential to invest with a long-term perspective and not react impulsively to short-term market fluctuations. Consulting a certified financial advisor can provide personalized guidance tailored to your risk tolerance and financial objectives.

Entrepreneurship as a Catalyst: Building Your Own Path to Riches

For many, the most direct and impactful answer to how to get rich lies in entrepreneurship. While traditional employment offers stability, it often caps earning potential. Starting your own business, however, provides unlimited upside potential, allowing you to create value, solve problems, and scale your income far beyond what a salary might offer. Entrepreneurship demands hard work, resilience, and a willingness to take calculated risks, but the rewards can be transformative. It allows you to leverage your skills, passion, and vision to build something truly impactful.

Successful entrepreneurs identify unmet needs or inefficiencies in the market and develop innovative solutions. They are problem-solvers who are passionate about their products or services. This path requires not just a great idea, but also meticulous planning, effective execution, and continuous adaptation. Building a strong team, understanding your target market, and developing a robust business model are all critical components. The journey is often challenging, but the freedom and financial rewards can be immense.

Identifying Market Gaps and Opportunities

A core skill for any aspiring entrepreneur is the ability to identify market gaps – unfulfilled needs or underserved customer segments. This involves keen observation, market research, and understanding current trends. Look for pain points that people experience, inefficient processes, or areas where existing solutions are inadequate. Opportunities can arise from technological advancements, demographic shifts, changes in consumer behavior, or even new regulations.

For example, the rise of remote work created opportunities for collaboration software and home office solutions. Increased environmental awareness has fueled demand for sustainable products and services. Regularly read industry reports, attend trade shows, network with professionals, and most importantly, listen to potential customers. The ability to spot and capitalize on these opportunities is a defining characteristic of those who successfully navigate the entrepreneurial path to how to get rich.

The Power of Place: Why Location is Paramount for Business Success

When discussing how to get rich through business, the importance of location cannot be overstated. For many businesses, particularly retail, hospitality, and service-based operations, location is not just a factor; it's a critical determinant of success. A prime location can provide unparalleled visibility, accessibility, and proximity to your target demographic, directly impacting customer traffic, sales volume, and overall profitability. Conversely, a poor location, no matter how good your product or service, can severely hinder growth and even lead to failure.

Consider a coffee shop: a location near a busy office building or a university campus will likely thrive due to consistent foot traffic, whereas one tucked away in a quiet residential street might struggle. For online businesses, "location" might translate to digital visibility (SEO, social media presence), but even then, understanding the geographical distribution of your target audience remains vital for targeted marketing and logistics. Strategic location planning involves extensive research into demographics, competitor analysis, traffic patterns, and local regulations. It's an investment that pays dividends by maximizing your business's exposure and potential for growth.

Maximizing Output from Your Perfect Business Location

Once you've identified what you believe is the perfect location for your business, the next step is to maximize its output. This isn't just about having customers walk through the door; it's about optimizing every aspect of your operation to leverage the location's advantages. For a physical store, this could mean:

- Visibility and Signage: Ensure your storefront is highly visible and your signage is clear, attractive, and easily readable from a distance.

- Accessibility: Is there ample parking? Is it easily reachable by public transport? Is it ADA compliant?

- Store Layout and Merchandising: Optimize the interior layout to guide customer flow, highlight key products, and create an inviting atmosphere.

- Local Marketing: Engage with the local community. Participate in local events, sponsor local teams, or run promotions specifically targeted at residents or businesses in the vicinity.

- Operational Efficiency: Ensure your staff can handle peak times effectively. A great location can quickly become a bottleneck if operations aren't streamlined.

For an e-commerce business, maximizing "location" (digital presence) output means optimizing your website for search engines, running targeted digital ad campaigns, and ensuring a seamless user experience. The goal is to convert the potential offered by your chosen "place" into tangible sales and revenue, accelerating your journey on how to get rich.

Navigating the Business Landscape: Threats and Opportunities

No business operates in a vacuum. To sustain growth and truly understand how to get rich through your ventures, you must constantly analyze the external environment for both threats and opportunities. This process, often part of a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis, is crucial for strategic planning and long-term resilience.

Opportunities are external factors that your business can leverage for growth. These might include:

- Emerging Technologies: New tools or platforms that can improve your product, service, or operational efficiency.

- Changing Consumer Preferences: Shifts in what customers want or value, creating new markets or demands.

- Economic Growth: Increased disposable income or business spending.

- New Markets: Untapped geographical areas or demographic segments.

- Favorable Regulations: Government policies that support your industry or business model.

Threats are external factors that could negatively impact your business. These require proactive mitigation strategies:

- Increased Competition: New entrants or existing competitors gaining market share.

- Economic Downturns: Recessions or reduced consumer spending.

- Technological Disruptions: New innovations that render your product or service obsolete.

- Regulatory Changes: New laws or policies that increase operational costs or restrict your activities.

- Supply Chain Issues: Disruptions in the availability or cost of raw materials or components.

- Reputational Risks: Negative public perception or social media backlash.

Regularly assessing these factors allows you to adapt your strategies, innovate your offerings, and build a more robust and future-proof business, which is essential for a sustainable path to how to get rich. For instance, during the COVID-19 pandemic, many businesses faced the threat of lockdowns but found opportunities in e-commerce and delivery services. Those who adapted quickly survived and even thrived.

Diversification and Risk Management: Protecting Your Growing Wealth

As your wealth grows, the focus shifts from merely accumulating assets to protecting them. Diversification and robust risk management are paramount for anyone serious about how to get rich and, more importantly, stay rich. Putting all your eggs in one basket, whether it's a single stock, a single business, or a single income stream, exposes you to significant risk. Economic downturns, industry-specific challenges, or personal setbacks can quickly erode wealth if it's not diversified.

Diversification applies to both investments and income streams. For investments, this means spreading your capital across various asset classes (stocks, bonds, real estate, commodities), industries, and geographies. For income, it means exploring multiple revenue streams, such as a primary job combined with a side hustle, rental properties, or passive income from investments. Risk management also involves having adequate insurance (health, life, property, business liability), maintaining an emergency fund, and regularly reviewing your financial plan to adjust to changing circumstances. As Benjamin Graham, the father of value investing, wisely stated, "The investor's chief problem — and even his worst enemy — is likely to be himself." Managing emotional reactions to market volatility is a key aspect of risk management.

Continuous Learning and Adaptation: Staying Ahead in the Wealth Game

The world is constantly evolving, and so too must your approach to wealth creation. Those who successfully figure out how to get rich and maintain their financial standing are perpetual learners. They stay informed about economic trends, technological advancements, and shifts in consumer behavior. This commitment to continuous learning allows them to adapt their strategies, identify new opportunities, and mitigate emerging threats before they become insurmountable.

This could involve reading financial news, taking online courses, attending seminars, networking with other successful individuals, or hiring mentors. The digital age has democratized access to information, making it easier than ever to acquire new skills and knowledge. Whether it's learning about new investment vehicles, understanding blockchain technology, or mastering digital marketing for your business, staying curious and open to new ideas is a powerful asset in your wealth-building arsenal. Complacency is the enemy of progress in the journey to financial prosperity.

Giving Back: The Philanthropic Aspect of True Riches

While the initial drive to how to get rich often focuses on personal financial security and freedom, many truly wealthy individuals find profound satisfaction in philanthropy and giving back to society. Accumulating wealth can provide the means to make a significant positive impact on the world, whether through charitable donations, establishing foundations, or investing in social enterprises. This aspect of wealth goes beyond mere financial accumulation and speaks to a deeper sense of purpose and legacy.

Giving back can take many forms, from volunteering your time and expertise to making substantial financial contributions. It's not just about writing a check; it's about leveraging your resources to address societal challenges, support causes you believe in, and empower others. This approach often brings a sense of fulfillment that financial gain alone cannot provide, enriching not only the lives of others but also your own. True riches often encompass not just what you have, but what you contribute.

The journey to understand how to get rich is a marathon, not a sprint. It demands a clear vision, unwavering discipline, continuous learning, and a willingness to adapt. From cultivating a wealth-building mindset and mastering financial literacy to strategically investing and, for many, embarking on the entrepreneurial path, every step builds upon the last. We've explored the critical importance of business location, the necessity of analyzing threats and opportunities, and the wisdom of diversification and continuous learning.

Remember, wealth is not just about the money you accumulate, but the freedom it provides and the positive impact you can create. By consistently applying these principles, you're not just building a financial portfolio; you're building a life of purpose and prosperity. What steps will you take today to begin or advance your journey towards lasting wealth? Share your thoughts in the comments below, and consider exploring other articles on our site for more insights into personal finance and business growth.

- Dodgers Nation

- Ondo Jersey City

- Publican Quality Meats

- American Prohibition Museum

- Northeast Baptist Hospital

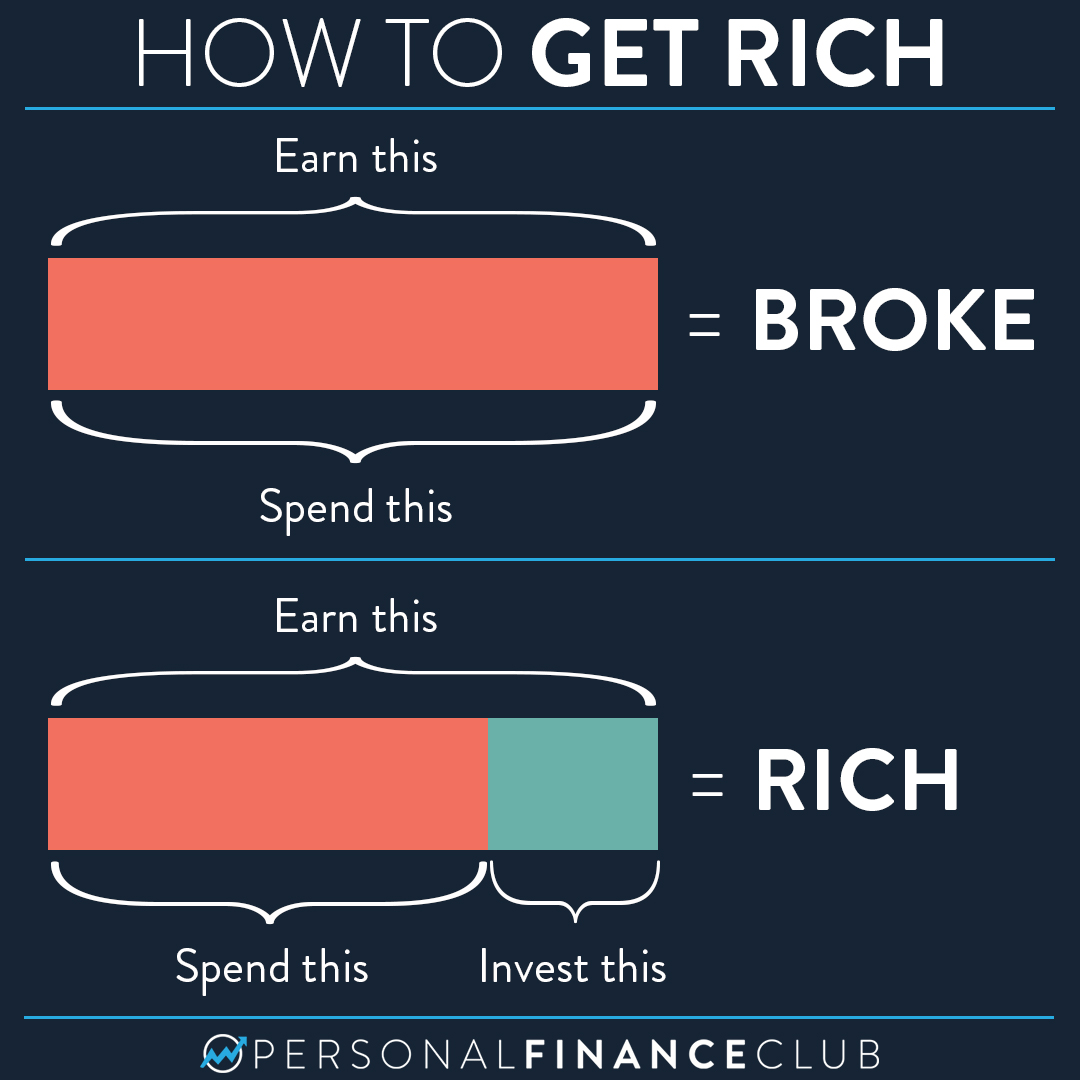

The simple way to get rich – Personal Finance Club

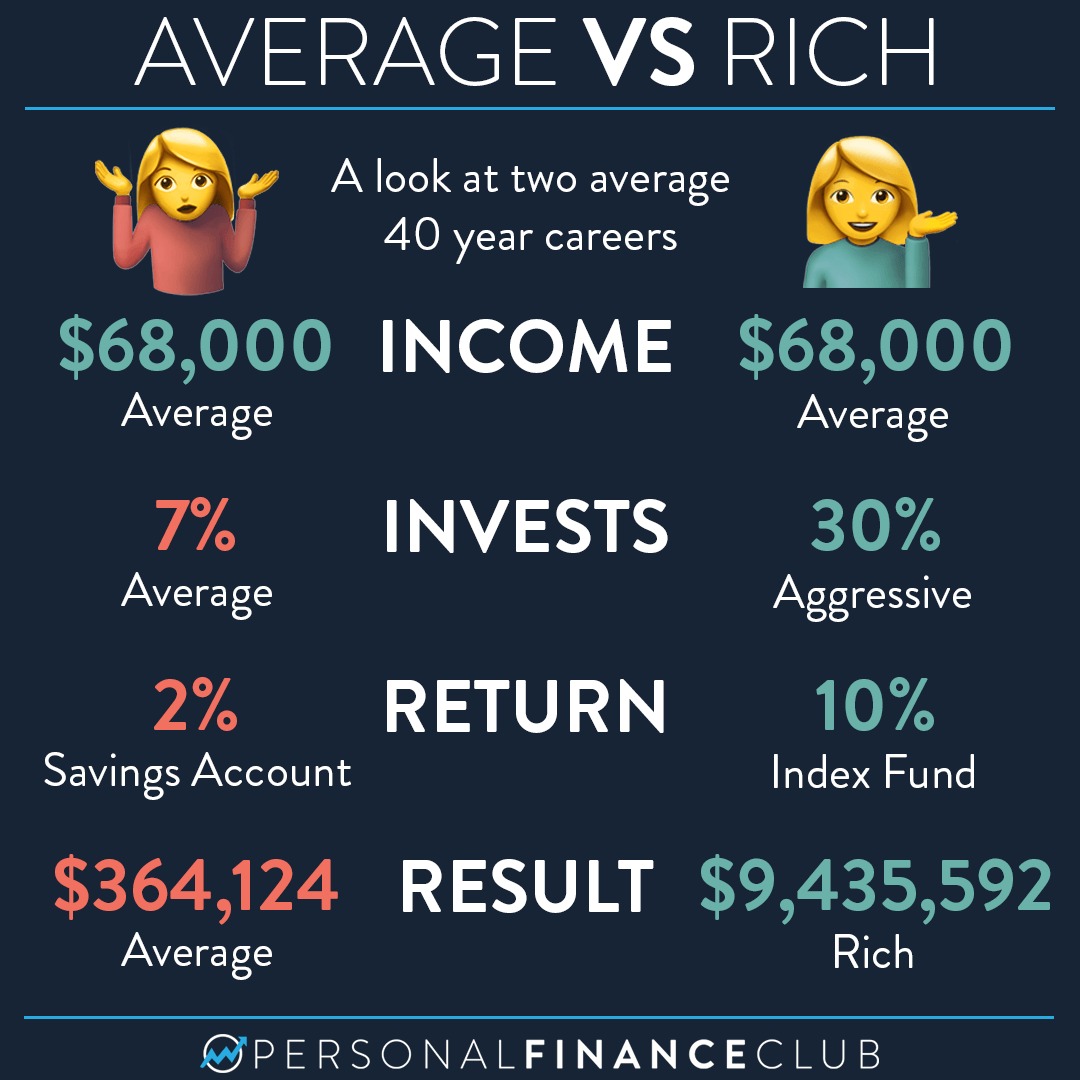

How to get rich with an average career – Personal Finance Club

How do I get rich from making $60,000 a year? – Personal Finance Club